In a significant downturn, the Pakistan Stock Exchange (PSX) experienced a considerable setback on Tuesday, witnessing a sharp decline of more than 2,500 points, equivalent to over 4%. This substantial drop was primarily triggered by a massive sell-off initiated by key market players.

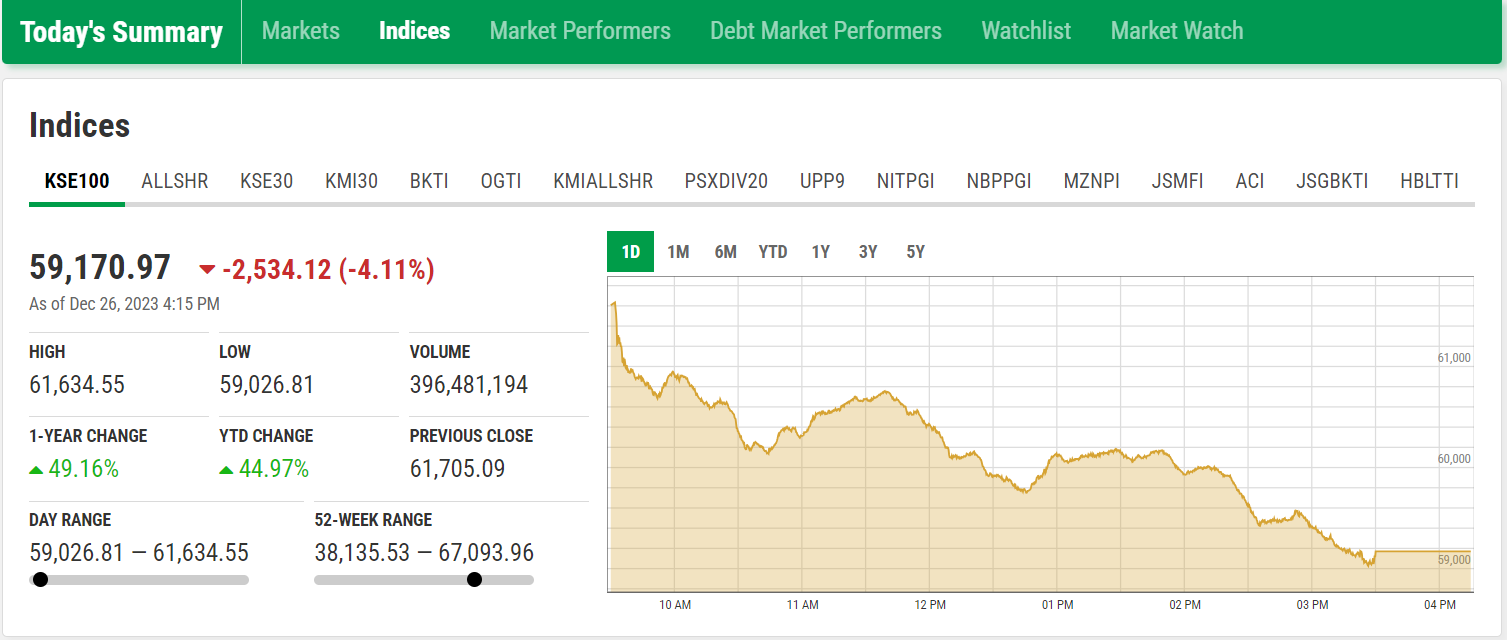

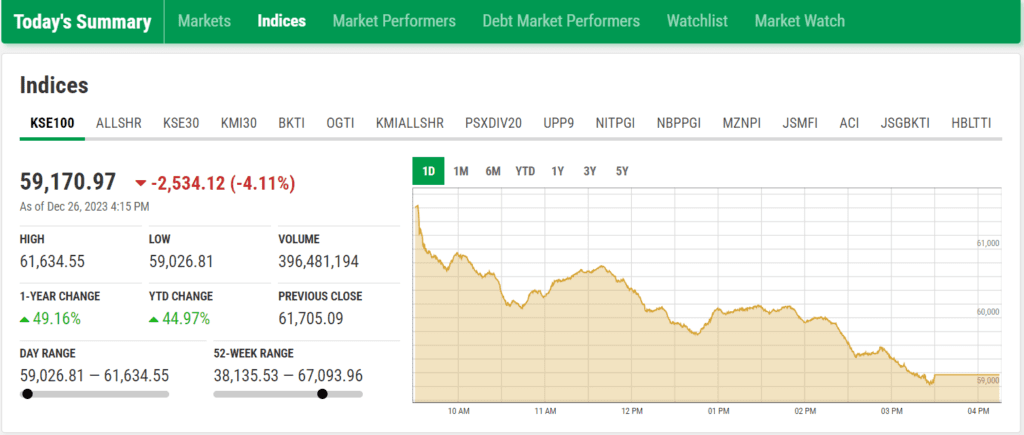

According to data from the PSX website, the KSE-100 index, the market’s benchmark, concluded the trading day at 59,170.97 points. This marked a notable decrease of 2,534.12 points, or 4.11%, compared to the preceding close of 61,705.09 points on December 22.

PSX Website

The day commenced on a negative trajectory, with the market displaying early signs of distress. By 9:50 am, it had already shed over 1,009.92 points, reaching 60,695.17 points. As the day unfolded, the decline continued, and by noon, the KSE-100 had lost 1,500 points, settling at 60,120 points.

The situation was exacerbated after 2:00 pm, witnessing a steep plunge of 2,000 points. At 3:26 p.m., the benchmark index hit its lowest level of 59,026.81, reflecting a remarkable decline of 2,678.28 points. This abrupt drop constituted the most significant single-day fall in the history of KSE-100.

Nearly all major sectors of the market were painted red as investors divested their holdings. Industries such as automobile assemblers, cement, chemicals, commercial banks, oil and gas marketing companies, oil and gas exploration companies, refineries, and pharmaceuticals were among the hardest hit.

Furthermore, exchange-traded funds, fertilizer, food and personal care products, insurance, investment banks, and securities companies faced substantial selling pressure.

Market experts attributed this selling pressure to a correction phase following a period of impressive growth for the PSX, which had reached record high levels, surpassing 67,000 points in recent weeks. Despite this setback, the benchmark index’s 11% drop in just nine sessions was viewed as a healthy and temporary correction.

Experts remain optimistic, foreseeing a market rebound driven by robust fundamentals and a positive outlook in the near future.